iowa inheritance tax return schedules

Complete the separate schedules A E and G to determine the total value of all real estate. Register for a Permit.

Schedule G Inter Vivos Transfers And Misc Non Probate Property Rev 1510 Pdf

What is US inheritance tax rate.

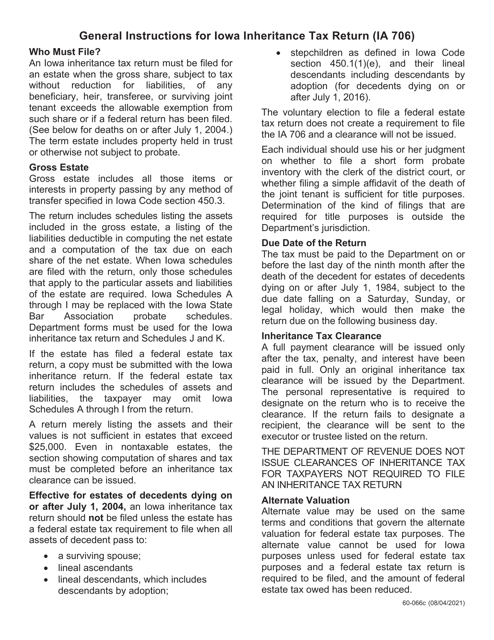

. Iowa Inheritance Tax Return Schedules. An Iowa inheritance tax return must be filed and any tax due paid on or before the last day of the ninth month after the death of the decedent. A bigger difference between the two states is how the exemptions to the tax work.

That is worse than Iowas top inheritance tax rate of 15. An Iowa inheritance tax return must be filed and any tax due paid on or before the last day of the ninth month after the death of the decedent. An extension of time to file the return and make.

If the estate has filed a federal estate tax return a copy must be submitted with the Iowa inheritance. Enter this on line 1. Iowa Inheritance Tax Schedule K 60-085.

Learn About Sales. If the estate has filed a federal estate tax return a copy must be submitted with the Iowa return. The vast majority of estates 999 do not pay federal estate taxes.

Inheritance Tax Rates Schedule. Fiduciary IA 1041 Schedule I Iowa Alternative Minimum Tax Franchise. An Iowa inheritance tax return must be filed if estate assets pass to both an individual listed in Iowa Code section 4509 and that individuals spouse.

IA 706 Inheritance Tax Return Instructions 60-066. Department forms must be used for the Iowa inheritance tax return and Schedules J and K. Dup 219 gdb put learn about sales use tax.

While the top estate tax rate is 40 the average tax rate paid is just 17. The Departments inheritance tax return and the liabilities Schedules J and K will be accepted. Change or Cancel a Permit.

25001-75500 has an Iowa inheritance tax rate of 7. Iowa is planning to completely repeal. 12501-25000 has an Iowa inheritance tax rate of 6.

What is the federal inheritance tax rate for 2020. Iowa InheritanceEstate Tax Return IA 706 Step 4. Track or File Rent Reimbursement.

4504 additionally no inheritance tax return is required if the. The inheritance tax return must be filed and any tax due must be paid on or before the last day of the ninth month after the death of the decedent or life tenant. Stay informed subscribe to receive updates.

If your relation to the person leaving you money is any of the above you wont owe inheritance tax regardless of the size of your inheritance. Learn About Property Tax. Iowa Inheritance Tax Schedules.

If the estate has filed a federal estate tax return a copy must be submitted with the Iowa return. If the deceased persons net estate discussed below is worth 25000 or less no. Read more about IA 706 Inheritance Tax Return Instructions 60.

0-12500 has an Iowa inheritance tax rate of 5. An extension of time to file the return and make. While the top estate tax rate is 40 the average tax rate paid is just 17.

The departments Inheritance Tax Return and the liabilities Schedules J and K will be accepted. Read more about Inheritance Tax Rates Schedule. IA 1120F Franchise Return for Financial Institutions Franchise IA 1120F Franchise Estimated Worksheet.

An extension of time to file the.

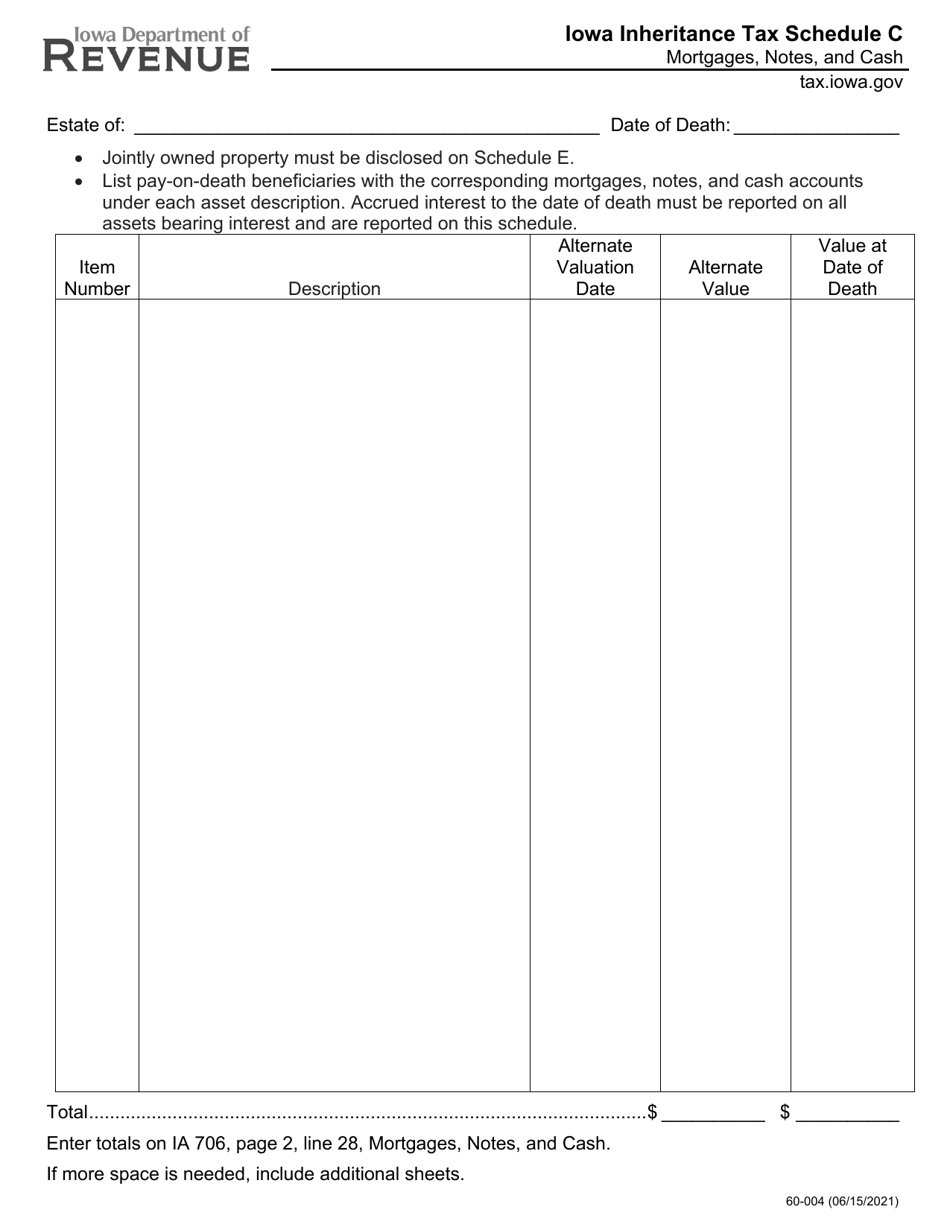

Form 60 004 Schedule C Download Printable Pdf Or Fill Online Iowa Inheritance Tax Mortgages Notes And Cash Iowa Templateroller

Iowa State Back Taxes Understand Tax Relief Options And Consequences

Recent Changes To Iowa Estate Tax 2022

Download Instructions For Form Ia706 60 008 Iowa Inheritance Tax Return Pdf Templateroller

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub

Iowa Inheritance Tax Law Explained

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Do I Have To Pay Taxes When I Inherit Money

Michigan Inheritance Tax Explained Rochester Law Center

.png)

Iowa Inheritance Tax Law Explained

Gift Tax Does This Exist At The State Level In New York

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

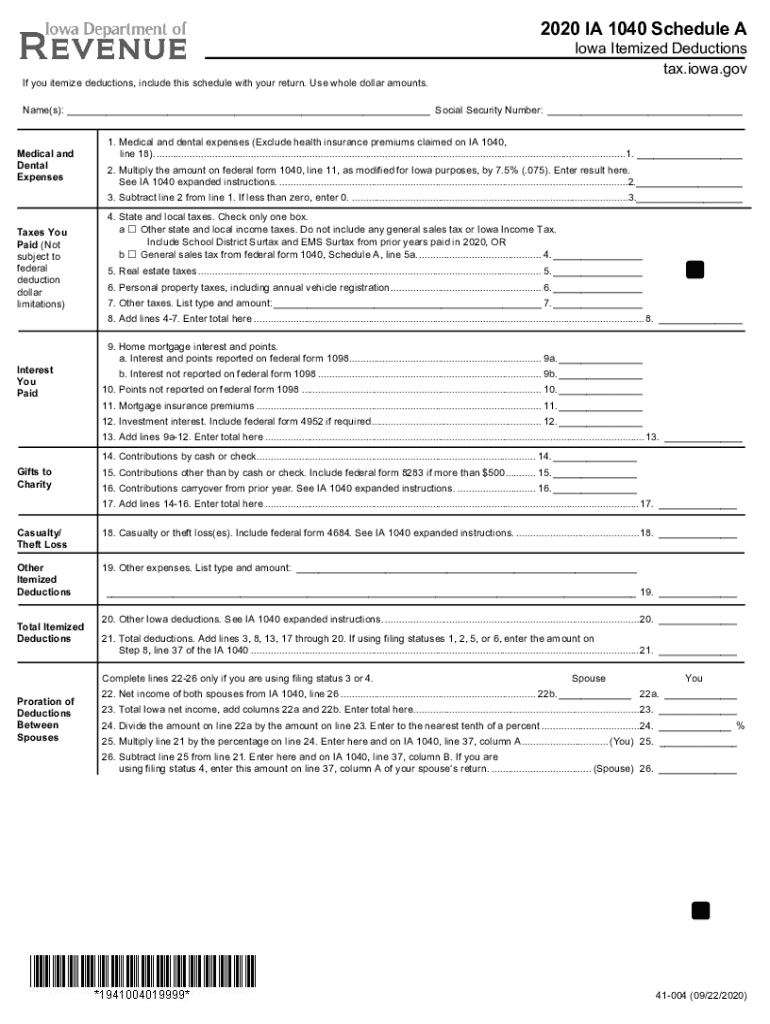

Ia 1040 Schedule A 2020 2022 Fill Out Tax Template Online Us Legal Forms

Iowa Inheritance Tax Law Explained Youtube

Instructions For Iowa 706 Schedule K Form Fill And Sign Printable Template Online Us Legal Forms

Iowa Power Of Attorney Form Ia 2848